King vs. Burwell

Stanley Feld M.D.,FACP,MACP

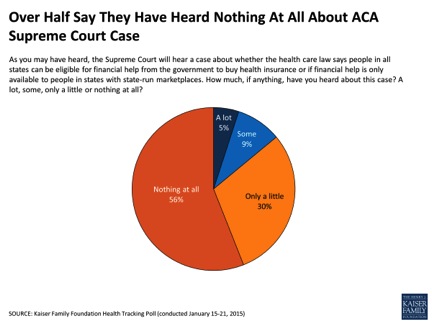

In January 2015 fifty-six percent of the population surveyed knew nothing at all about the King vs. Burwell case to be heard by the Supreme Court in March 2015. Only 5% said they knew a lot about it. Nine percent said they knew something about it. Thirty percent of those surveyed said they knew only a little about the case.

I could not believe these numbers. So I decided to do a little personal survey of college graduates I ran into during the week. These people, in my opinion, are educated people. They would not consider themselves low information voters. Some, informally surveyed, were physicians.

To my amazement the numbers in the Kaiser survey taken before the Supreme Court hearing were similar to my informal survey taken after the Supreme Court hearing.

The leaders of the Republican Party are hoping the Supreme Court will uphold the challenge to Obamacare. They hope a favorable decision will subsequently cause Obamacare to collapse. The Republican Party would rather not have a open public debate about the federal health exchange’s unconstitutional subsidies.

The Republican Party does not want to be blamed for Obamacare’s collapse. They are also afraid to present Obamacare’s defects to the American people in simple terms. They are afraid to provide the leadership necessary to create outrage by the populous to stimulate public pressure to repeal this awful law.

King vs Burwell is a very simple case. The Affordable Care Act was passed into law by a partisan vote. The ACA did not receive one Republican vote.

None of the stakeholders approve of it. President Obama has made temporary modifications to the law to prevent a united popular outrage against the law.

The lawsuit by King against the Obama administration’s head of HHS, Sylvia Burwell, is that Obamacare (partisan passed law) is not upholding the letter of the law.

The law clearly states that only states with a state health insurance exchange can provide subsidies for the purchase of healthcare insurance.

The Obama administration is providing subsidies through the 39 federal health exchanges. There are 39 federal health exchanges because 39 states refused to participate in the formation of a state insurance exchanges.

The law was written that way to encourage states to set up the exchanges. There is plenty of profit built into the state exchanges for the debt-ridden states to decrease its deficits.

As a result of the poor state response, President Obama even promised to fully fund the program for three years. He received little state response to that proposal.

The states that did not set up state exchanges exercised their states rights. Those states could visualize the losses they would incur when the first three years were over. It would necessitate the states to raising taxes on their citizens in order to avoid bankruptcy.

These states were also opposing a federal take over of the authority given to the states by the constitution.

A few state exchanges have closed down all ready even with total federal funding. In many cases people were not signing up because the insurance was too expensive.

The issue before the Supreme Court is simple.

The job of the executive branch of government is to implement and enforce the law as written. The executive branch of government cannot change the law without the consent of congress.

The lawsuit against the Obama administration is a constitutional question. It is nothing else.

If the court rules for the Obama administration, then President Obama has set a precedent so laws can be rewritten by the executive branch of government without the consent of congress.

In reading the extensive coverage of the New York Times by Margot Sanger-Katz everything but the constitutional issue is discussed.

All sorts of emotional issues are discussed such as 7 million people will loss their healthcare insurance subsidy and in turn lose their healthcare insurance coverage.

As stakeholders have tried to adjust to the law, they have discovered ways to profit from the law. Now some of the stakeholders now do not want the executive order to be ruled unconstitutional because it will harm their vested interest.

The administration’s argument focuses on everything but the core issue in this case. The executive branch (President Obama) cannot change the letter of the law. The legislature is the only body in our checks and balances system that can change the law. Therefore, President Obama’s action is unconstitutional.

Worse yet, the Obama administration by itself and through its surrogates, such as the mainstream media (New York Times), have been muddying the water in an effort to intimidate the Supreme Court and its decision.

The Obama administration has begged the constitutional question in favor of having the public generating pity for the 7 million people who could lose their healthcare coverage.

Many of those 7 million people cannot afford the healthcare coverage provided by the health exchanges.

President Obama has also said, over and over again, that the Republicans have not provided a better plan to influence the court in considering the simple constitutional issue.

The solution is simple. The Obama administration should ask congress to change the law.

The administration should ask a Democratic congressman to amend the law to changing the language of the law so that the federal healthcare exchange can provide subsidies.

If the executive branch is permitted to change a law, America could be on the path toward a dictatorship.

The Obama administration has announced that is has no contingency plan if the Supreme Court rules against it.

This could be interpreted in two ways. President Obama believes he is on the right side of the constitution. He feels that the Supreme Court judges have no choice but to agree with him.

The second is the Supreme Court will be intimidated by President Obama and modify the reading of the constitution to have a broader interpretation. The court will let the executive branch change the law as written to one that fits the President’s agenda.

I do not believe the Supreme Court will be intimidated. I do not believe the media will affect the decision of the Supreme Court.

In fact the Obama administration has been working secretly with alternative plans. Unfortunately these plans are intended to bypass a Supreme Court decision and not execute the Supreme Court’s decision.

This is a very important constitutional issue.

The Republicans must start to educate and heighten awareness of this decision by the public.

It is unacceptable and sad that only 53% of the public is aware of the case much less the importance of the decision.

https://mail.google.com/mail/u/0/#inbox/14c3d6566f26ca10?projector=1

The opinions expressed in the blog “Repairing The Healthcare System” are, mine and mine alone

Please have a friend subscribe