Not One Dime In New Taxes

Stanley Feld M.D.,FACP,MACE

I received a note from a reader last week. I debated with myself whether or not to publish it. Americans have discovered, and are continuing to discover, President Obama’s many lies/deceptions about Obamacare.

He kept telling us that the law would only tax families earning over $250,000 a year. People earning less than $200,000 per individual and $250,000 per family will not pay a dime more in taxes.

“No family making less than $250,000 will see "any form of tax increase."

"I can make a firm pledge. Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes."

Sources: President Obama

Subjects: Taxes”

It has become apparent that President Obama and his administration have told the American people many lies during his administration. The lies are at best half-truths. President Obama promised us an administration that would be totally transparent and truthful.

Americans trusted him to live up to his promise.

Many believed him only to find out he was not telling the truth.

The traditional media has supported many of President Obama’s lies. This same media had zero tolerance for George H Bush’s (41) lie.

“Read my lips’. No new taxes.”

There are at least ten hidden taxes imbedded in Obamacare.

In the last few weeks we learned that an insurance industry bailout was imbedded in Obamacare. President Obama knew about the bailout at the time Obamacare was passed.

Nancy Pelosi was correct. “We won’t know what is in the bill until we passed it.”

Americans used to trust their leaders. This administration has made us very cynical.

There is something called a “Medical Device Excise Tax.” This medical device excise tax is in the original Obamacare legislation. The 2.3% tax is imposed on the manufacturers of the medical device.

The 2.3% is ultimately passed on to all, both the rich and the poor.

The reader sent me the following:

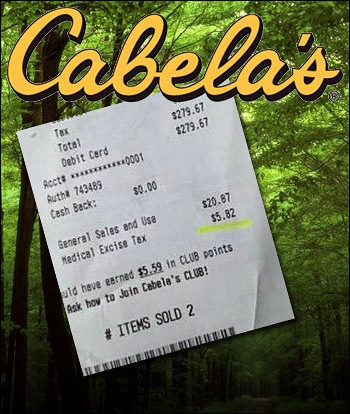

"The 2.3% Medical Excise Tax that began on January 1st, 2013 as part of Obamacare’s tax structure is supposed to be "hidden" from the consumer, but it's been brought to the public's attention by hunting and fishing store Cabela's who have refused to hide it and are showing it as a separate line item tax on their receipts, the email states.

I did some research and found directly from the IRS 's website information that PROVES this to be true and an accurate portrayal of something hidden in Obamacare that I was not aware of! Now being skeptical of this I went to the IRS website and found this!"

"Q1. What is the medical device excise tax? A1. Section 4191 of the Internal Revenue Code imposes an excise tax on the sale of certain medical devices by the manufacturer or importer of the device sales of taxable medical devices after Dec. 31, 2012.

Q3. How much is the tax? A3. The tax is 2.3 percent of the sale price of the taxable medical device.

So being more curious I clicked on "Chapter 5

of IRS Publication 510."

And what do I find under "MEDICAL DEVICES" under

"MANUFACTURERS TAXES"?

The following discussion of manufacturers taxes

applies to the tax on:

Sport fishing equipment;

Fishing rods and fishing poles;

Electric outboard motors;

Fishing tackle boxes;

Bows, quivers, broadheads, and points;

Arrow shafts;

Coal;

Taxable tires;

Gas guzzler automobiles; and

Vaccines."

"I think we have definitely been fooled, if we believe that the Affordable Care Act is all about health care. It truly does appear to be nothing more than a bill laden with a whole lot of taxes that we the people have yet to be aware of."

"Please pass this on. I am still incredulous that this can go on.

Where is our press ?

What is next? What else is there we do not know about? God help us ."

This is not the first time we have not been told the truth by this administration.

However I did my own fact checking and discovered that the author misread Chapter 5 of IRS Publication 510 Excise Taxes, and Notice IRS Publication 510.

The publication deals with all things subject to excise taxes. Chapter 5 covers “manufacturers taxes” of which the medical devices excise price 2.3% is a part of.

The anonymous author found the list of items including fishing equipment, bows and cars. Some of these excise taxes existed pre Obamacare. Some of the manufacturers excise taxes are a result of Obamacare. They are all separate from the medical device excise tax.

The publication says the tax on fishing rods and fishing poles is a 10% excise tax not to exceed $10 per article.” The tax on fishing tackle boxes and electric outboard boat motors is 3 percent of the sales price. The tax on bows is even higher, at 11 percent.

Cabela was wrong in adding 2.3% to the final bill. It misread the law. The sporting goods store realized its error the first week adding stopped adding the excise tax. Cabela repaid customers who were charged the excise tax.

One must think of the increase in price of an item to all consumers for the manufacturers’ tax is in reality a hidden tax to the middle class. It reduces the consumers’ purchasing power.

This is true for the tax on tanning bed salons also.

What additional Obamacare taxes are affecting the under $200k/$250k earners?

1. Obamacare Home Sales Tax increases taxes on unearned income by 3.8%.

2. Obamacare increases the medical expense deduction threshold. Unreimbursed medical expense deductions will now be available only for those medical expenses in excess of 10% of AGI, which has been raised from 7.5%.

3. Starting in 2018, the new health care law imposes a 40% excise tax on the portion of most employer-sponsored health coverage that exceed $10,200 a year and $27,500 for families.

Unions who have negotiated these healthcare plans for its members are upset because the tax will severely affect its membership. Members might elect to quit the union.

There are many more hidden taxes I have not discussed in this discussion.

Democrats now admit after going through the new Obamacare taxes line by line that those taxes will increase the tax burden and decrease the purchasing power of the middle class.

President Obama has promised that Obamacare will help all Americans get access to quality affordable healthcare and new benefits, rights and protections.

So far Americans have seen the opposite occur.

The reaction to the Cabela incident is simply an indication of the middle class’ cynicism. President Obama promised people making less than $250,000 a year will not pay one dime more in taxes.

It is clear he knew that was a false promise at the time.

Americans do not trust President Obama anymore.

The opinions expressed in the blog “Repairing The Healthcare System” are, mine and mine alone.

Please have a friend subscribe