Employer Mandate Confusion

Stanley Feld M.D.,FACP,MACE

Confusion

about any rules or regulations is not good for business, bad for job growth and

bad for the economy. Large and small

enterprises become cautious and are afraid to spend money on expansion.

Expansion might increase a tax liability without increasing production.

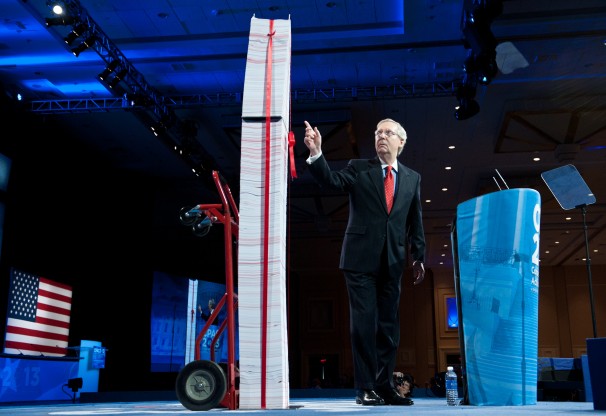

“Implementation has

also become a bureaucratic nightmare, with some 159 new government agencies,

boards and programs busily enforcing the roughly 20,000 pages of rules and

regulations already associated with this law.”

— Sen.

Mitch McConnell (R-Ky.), on the third anniversary of the law’s passage,

March 22, 2013

The process the McConnell folks used is fairly

simple. They went to the Web site for the Federal Register and

searched for “Affordable Care Act,” the official name for the health-care law.

That turned up 897 documents.

On the Web site, there’s a button that will download

the documents to an Excel spreadsheet (CVS/excel). Then you use the sum feature

on Excel to add up the pages and presto, you end with 20,202 pages. These were

then printed out and duly stacked in a pile.

Mitch

McConnell might be way off in his calculation. The rules and regulations are

reported in the small print Federal Register. It is possible as many as 40,000

rules and regulations have been published. All of the rules and regulations for

Obamacare will not have been written by January 1, 2014.

The

cost of the writing of the rules and regulations, the cost of the formation of

new agencies formation, and the cost of implementation have not been discussed.

Rules

and regulations tend to be open to misinterpretation, conflict, lawsuits and

lack of enforcement.

An

increase in rules and regulations leads to more confusion and conflict. Some

rules contradict other rules. This results in greater inefficiency and more not

less costs.

Our

healthcare system can ill afford more non added value expenses.

I

have written about employers decreasing the number of hours employees are

permitted to work in order to avoid the penalty “tax”

of not providing healthcare insurance for full time workers.

Seventy

seven percent of the “job growth” in the past few months has been part time

employment growth. The Obama administration has consistently denied this is

true despite the Bureau of Labor statistic reports.

What

is part time employment? It has been defined in Obamacare as an employee

working less than 30 hours a week.

“Just to understand how the penalty applies practically requires

a flow chart. But as the Internal

Revenue Service has tried to interpret the mandate, the

agency and the businesses and employees affected by the mandate are discovering

that it is even more challenging than it reads.”

Answers to questions by

the I.R.S. have generated even more questions. Confusion mounts as more rules

and regulations are generated.

A big question has

surfaced. How does an employer determine whether employees whose hours fluctuate

should be offered insurance or pay a penalty “tax”?

Obamacare sets that

threshold at 30 hours per week. Many companies schedule some of their work

force on variable hours. An employee might work 25 hours one week and 33 hours

another week.

In its preliminary

rules, released late last year,

the I.R.S. devised an approach to the problem of the variable-hour employee

that it calls the “look-back measurement method.”

The I.R.S regulations

would allow an employer to choose a measurement period of three months to a

year in which to average the employee’s weekly hours.

The measurement period

would then be followed by a stability period of a year for a total of two

years.

Is anyone following this?

If an employee’s schedule

averaged out to full time (over 30 hours a week) during the measurement period,

then the company would be obliged to offer health insurance in the stability

period or pay a penalty.

The new measurement period

would begin immediately after the old one ended. The process of measurement and

stability periods would begin again.

If the company anticipates that a new hire

will work full-time (over 30 hours a week), it must offer insurance by the

start of the fourth month on the job.

Why not offer insurance immediately on hiring

the person? Is this not confusing?

To make things more confusing, what happens if

an employee goes from full time to part-time?

The rules were unclear. “Do you get to keep your coverage?”

The I.R.S. took the

position that the employee would keep the coverage through the end of the

stability period.

If it turned out that the

worker still managed to average a full-time schedule, which would be possible,

if he or she made the switch late in the period. The company would have to

offer insurance in the next stability period as well or face the penalty.

A full-time employee who was

switched to part-time in August, before open enrollment in October, would be

entitled to an additional 16 months of insurance coverage.

Employers have figured out

they should fire the employee and avoid the penalty or the insurance coverage.

This is not good for job creation or the economy.

The law and its rules are

encouraging these actions.

The rule also penalizes an

employee who is switched from part time to full time employment. The employee

has to wait at least a year before the employer must offer that employee

insurance coverage rather than by the fourth month.

“Measurement and stability

periods should be used to infer a status of variable-hour employees only,”

“Once an employee is no longer a variable-hour employee and is

in a full-time position, he or she should be offered coverage within, at most,

four calendar months.”

Is all this confusing? You

bet. Just visualize the cost of the mountain of paper work and reports.

Is all of this cost

effective? No!

This represents a tiny

fraction of the rules and regulations by the Affordable Care Act (Obamacare) that

are causing confusion.

The more confused one gets

the less one wants to participation.

The only option left is a government

take over of the healthcare system. It wouldn’t be bad except for the fact that

America cannot afford it, and the government could not implement it without a

terrible cost to society.

It would result in

rationing of care and a decrease in access to care. The only solution is for

consumers to be responsible for their own care and control their own healthcare

dollars.

The opinions expressed in the blog “Repairing The Healthcare System” are, mine and mine alone

Please have a friend subscribe

spinal shock cure • October 2, 2013

A dog’s nail consists of two parts, the quick which contains blood vessels and is the base of the nail. All in all, controlling the cost of health insurance plans is essential. Most people who change or lose their jobs also end up losing the health coverage and the Health Insurance Portability and Accountability Act (HIPAA) that was passed in 1996 intends to protect individuals and their families from loss of health insurance.