I Gave President Obama An Alternative To Obamacare

Stanley Feld M.D.,FACP, MACE

I formulated an alternative to Obamacare in 2006, long before Obamacare existed. President Obama has ignored a plan that will work and align every stakeholder’s incentive.

Obamacare is failing because President Obama does not know who the customer is in the healthcare system. He is blinded by ideology and the belief that government knows what consumers need.

The consumer is the customer. Without consumers of medical care and physicians to provide medical care we would not need a healthcare system.

Consumers and physicians are the primary stakeholders. All the others are secondary stakeholders.

However, physicians receive between 15-20% of the healthcare dollars. Hospitals receive 25% of the healthcare dollars.

Where does the remaining 60% of the healthcare dollars go?

The insurance industry takes at least 40% off the top. The pharmaceutical industry receives 10% and the government wastes 10%.

It is a pity that only 40% of our healthcare dollars is spent on direct medical care. There is much waste and inefficiency built into that direct medical care.

There is also much waste included in the 60% the secondary stakeholder take off the top.

How else would UnitedHealth’s CEO get paid $1.8 billion dollars in cash and stock options from 1998 to 2006?

The excessive insurance industry profits are the direct result of ineffective regulatory agencies controlling insurance pricing.

In 2006 consumer power was demonstrated when UnitedHealth tried to decrease reimbursement to Hospital Corporations of America. HCA protested and threated to quit participation in United Health. Consumer protests followed.

UnitedHealth was the main insurance carrier in the Denver Area. Consumers threated to boycott buying insurance from UnitedHealth. UnitedHealth backed off.

The HCA/United pushback is the first big step. It represents how “Patient Power” should work. Patients should be madder than hell and not want to take it any more.”

In 2006, many of the uninsured were self employed consumers who cannot qualify for insurance because they have a preexisting illness or they are at risk for illness.

The insurance companies refused to sell them insurance. The same consumer in a group insurance plan by law would receive insurance from the same insurance company that turned down the individual.

A self-employed individual can only buy insurance with after tax dollars. A corporate employee receives healthcare insurance coverage with pre-tax dollars.

The same applies for the individual insurance market post Obamacare.

The price of insurance is very high for small businesses. The small business owners do not have the negotiating power of the large corporations.

This results in both the individual and small business not being covered by healthcare insurance. All of the above can be easily fixed.

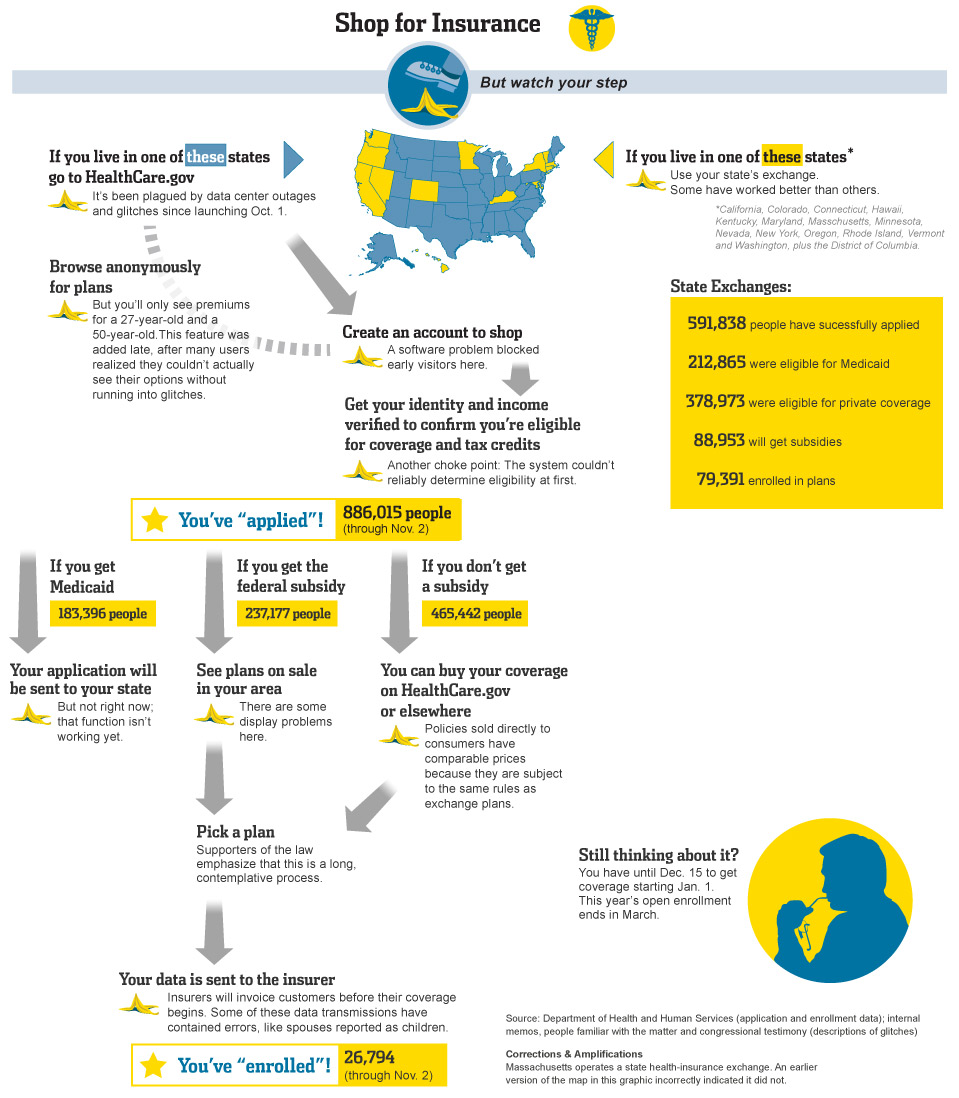

The problem with Obamacare is the insurance premiums are higher than they were pre- Obamacare. The reasons are obvious.

The only winner is the individual who makes a low enough income to receive a federal subsidy. The loser is the taxpayer.

Obamacare also creates a perverse incentive resulting in people not striving to get ahead.

In 2006 I wrote:

Patients drive the healthcare system. Patients have tremendous power. They must be taught to use that power in order to Repair the Healthcare System.

Patients must use their “Patient Power” to take control of their healthcare dollars and their health. They should be provided with financial incentives to save the money they spend on medical care.

Neither the healthcare insurance industry nor the government should determine the consumers’ access to care. Patients’ freedom of choice and self- responsibility is the key to Repairing the Healthcare System.

If there are financial incentives consumers will learn to become informed consumers of healthcare. Reliable education must be provided to give consumers the opportunity to become informed consumers.

There are preconditions.

Prices must be transparent so consumers know what they are buying. The insurance industry should negotiate the price with the physicians and the hospitals. The industry can remain the surrogate broker for the payment of money belonging to the consumer. Consumers’ who overspend will not receive the financial incentive. They will lose their medical saving account money. Patients who have an expensive illness, like diabetes, can be rewarded for spending money if they keep themselves in good health and prevent complications of disease.

The consumers are then the responsible party purchasing their medical care. It is not the healthcare insurance industry or the government.

The healthcare insurance industry or any financial industry with an adequate computer system can be the administrator and adjudicator of payment.

Medicare director Mark McClellan M.D. said that 90% of the healthcare dollar of a specific disease (Diabetes) is spent on the complications of disease. If we reduce the complications of a disease we could save at least 45% of the current healthcare expenditure for that disease.

Obamacare gives this vital fact lip service. It puts the responsibility of outcomes on physicians’ shoulders. If physicians have poor outcomes they get penalized.

The medical outcome is a dual responsibility of both consumers and physicians. Consumers should be made aware of physicians’ outcomes. Some of the poor outcomes are the result of consumers not taking the responsibility to learn about their disease, prevent the complications of their disease, or comply with the treatment recommended. The result is a poor outcome.

Consumer overspending is another important aspect of increasing healthcare costs. Consumers do not have incentive to be cautious with their healthcare dollars because they have been given first dollar coverage. They do not have financial incentives to save money on medical care.

Consumer overspending was best described by Victor Fuchs an economist from Stanford.

He made the case for a Consumer Driven Health Care System.

The Health Saving Accounts that congress has approved in my opinion is impotent. It does not provide a strong enough financial incentive for consumers to want to save money.

The trust account of $1,000 per year is too low to motivate consumers to become wise shoppers. A Medical Savings Account of $6,000 per year begins to represent financial motivation.

HSA’s represent the same false hope HMO’s and managed care represented in the 1980’s and 1990’s.

Dr. Fuchs calls it “The Restaurant Check Problem.”

“You go out to a restaurant with a bunch of friends and you sort of understand that you will split the check,” he said.

“The waiter comes along and says, ‘the lobster looks very good, and how about a soufflé for dessert?’

The restaurant check balloons, but you are not so careful because you figure everyone is splitting it.

“That’s the way medical care gets paid for,” he said.

Dr. Fuchs added, “We want to spend our money on the things that will bring the most value for the dollar.

When we are spending collective money as we are in health care, then it becomes much more difficult.”

We want Diabetics to spend money for good medical care in order to prevent complications. Prevention of complications will keep Diabetics out of the hospital and out of the emergency room. The result will be a decrease in medical costs.

The consumer driven healthcare plans can be set up to give provide Diabetic consumer the financial motivation to take care of himself. This reward is much cheaper than paying for a hospitalization or emergency room visit.

If an insurance product is overloaded with salaries, waste, overhead and unnecessary benefits patients will not buy the product.

The insurance product would have to be modified. It would become more cost efficient.

Patients have it in their power to remove the waste and inefficiency in the system.

Some very clever entrepreneur will realize the consumer is the customer. He will develop an insurance product that everyone wants. State governments have the power to encourage development of this product.

The examples in industry in America are numerous. Sam Walton revolutionized retailing in America with Wal-Mart and Sam’s. Michael Dell almost brought IBM to its knees and revolutionized the distribution of information technology.

My goal is to describe the necessary components of a healthcare insurance product that does not offer another and false hope.

I hope to show the way to develop an insurance product that can work for patients first and then all the other stakeholders.

There is no reason we cannot provide excellent affordable insurance coverage to all including the corporate employed, the small business employed, the self employed, the unemployed, and the Medicare covered seniors, with all the stakeholders making a reasonable profit in a simplified system.

President Obama, I have provided a viable alternative long before you became President.

I also provided this alternative to you when you became President in the letters I wrote to you.

For you to say no one has come up with a better alternative than Obamacare is disingenuous on your part.

I hope you are listening now.

The opinions expressed in the blog “Repairing The Healthcare System” are, mine and mine alone.

Please have a friend subscribe

Stan

I agree with your assertion that the greed of the insurance and drug industry leaders are wrong and that Obama and Congress accepted feeding that greed to get the ACA passed. It is time to correct that but, on the whole, I support the ACA. Here is my recently submitted letter to the Editor of the NC Med Journal about this:

To the Editor — The November/December NCMJ’s letter to the Editor, ‘Health Care Costs Must Come Down’ by Ron Howrigen, president of Fulcrum Strategies, Raleigh, NC, demands a response. This is mine.

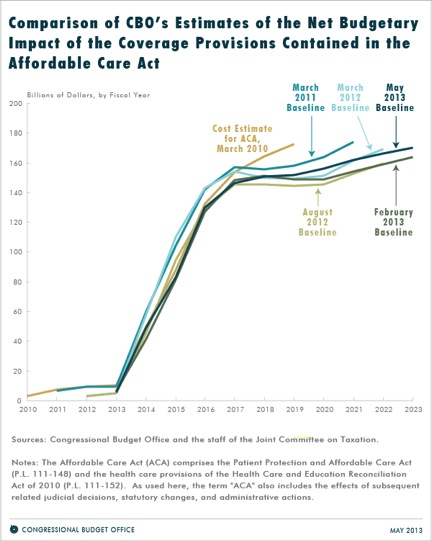

I heartily agree with the author that Health care costs must come down. This is inarguable and, in spite of the author’s pessimism, I note that the rate of rise of health care costs has already moderated since the Affordable Care Act ( ACA) was passed, even though it will cause a rise (estimated at 6%) as the millions of uninsured (at least double the 6%) are extended coverage by the ACA as it is fully implemented. However, the author totally avoided discussion of the ethical and moral issues the ACA sought to address, particularly the American public’s right to access and coverage of good health care. It has been our obligation, as fellow members of a wealthy nation, to provide that coverage after having failed to address it for over fifty years. Notably, the author, a consultant to physicians, is certainly not a disinterested party in the health care system and therefore his denial of any conflict of interest is hardly forthright. He actually admits his conflict in his statement of his ‘biggest concern,’ i.e. that the ACA will try to control costs by drastically reducing reimbursement to physicians. He and we must realize that our health care system is rapidly evolving to become not nearly as dependent on the physician as it has been in the past.

When the ACA was being considered by the Congress, those whose corporate bottom lines might be significantly impacted by it and the lobbyists who represent those interests read and studied the ACA carefully. I too read it, all of it. Yet few physicians or patients to whom I spoke had actually read even a small portion of the ACA. As I discussed it with others, I shared my excitement about the significant amount of the ACA which was directed to research ways to assess and improve medical care and coverage. I believe these aspects of the ACA had been included with the expectation that, someday, the findings of the research funded by the ACA could and would be used to improve health care and save money through the implementation of evidence-based practices and payment policies identified by that research. I am not unaware of the considerable compromises and gifts our elected officials in Washington, including our President, had to accept to get the ACA through Congress. I hoped that, over time, the positive effects and benefits of the ACA, such as the coverage of the nearly 50 million Americans without insurance and the removal of the pre-existing condition clauses, would be appreciated by most Americans. While I was disappointed especially in the failure of our President to be successful in his quest to avoid many of those concessions in the final ACA, I hoped those gifts to some corporate interests, including hospital, insurance, and pharmaceutical businesses, could be ameliorated or even reversed with time.

While I am dismayed by the unrelenting efforts in Congress to undo or limit funds for the ACA, the deficiencies of which are remediable, I remain excited about the good things which have already come and will be coming from this act, one of the most courageous, morally right steps our nation has ever taken.

Richard A Dickey, MD, FACP, FACE

Retired endocrinologist

51 Players Ridge Road

Hickory, North Carolina 28601-8839

radmd51@gmail.com

(828) 495-1230